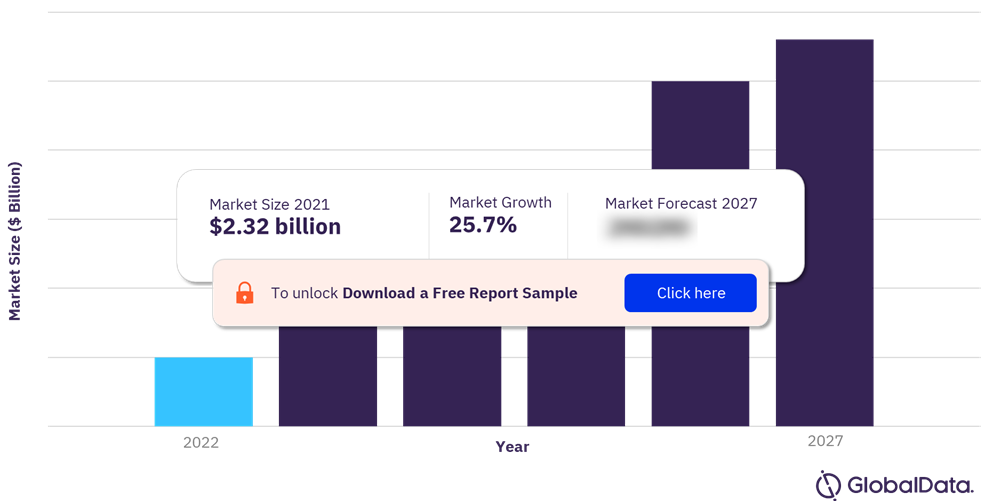

The latest market publication titled Digital Biomarkers Market Size, Share and Trends Analysis by Region, Product Type, End-user, and Segment Forecast, 2022-2027 has been added to the report store by GlobalData Plc. The report examines the digital biomarkers market growth to be mainly driven by the aging population and rising chronic diseases. In addition, increasing investments and funding to develop digital biomarkers coupled with rising M&A and partnerships are also likely to boost the adoption of digital biomarkers.

Download Sample Report for More Market Dynamics

Digital Biomarkers Market Outlook 2022-2027

The digital biomarkers market growth is also anticipated to be driven by prominent trends including the development of AI-based digital biomarkers. Furthermore, digital biomarkers have also emerged as an important predictive tool for supporting recovery from the global COVID-19 pandemic. These biomarkers have also emerged as a convenient tool for precision medicine. Despite the rising adoption and popularity of digital biomarkers, challenges including data standardization, interpretation issues, data maintenance issues, and difficulties in the validation of biomarkers might limit the market’s growth.

Digital Biomarkers Market Segment Highlights

The increase in the use and popularity of connected digital devices and health-related mobile apps has produced a novel set of large, diverse, and complex data sets known as “digital biomarkers.” Digital biomarkers are particularly pertinent with the ongoing COVID-19 pandemic, where RPM strategies are vital to monitoring patients infected with the virus and those at risk of contracting it. The report segments the digital biomarkers market as follows:

By Type

- Monitoring Digital Biomarkers: The monitoring digital biomarkers held the largest digital biomarkers market share in 2021. The segment will continue to account for the highest growth throughout the forecast period as these biomarkers usually measure certain parameters on a continuous basis to assess the status of a disease or medical condition.

- Diagnostic Digital Biomarkers

- Predictive Digital Biomarkers

- Others

By Product type

- Wearable Applications: The wearable applications segment accounted for the highest digital biomarkers market revenue in 2021. The segment will be driven by the rising popularity of smartwatches and fitness trackers. The soaring popularity of smartwatches is attributed to the perceived convenience and value they provide to consumers.

- Mobile Applications

- Portables

Read Sample Report for More Segments and their Revenue Opportunities

By Therapeutic Area

- Neurological and Mental Health: This therapeutic area segment is likely to garner the largest revenue in the digital biomarkers market. In neurology, digital biomarkers are used to diagnose and monitor diseases such as Alzheimer’s and Parkinson’s. Preventive analysis, delay of symptom onset, and monitoring using neurological digital biomarkers enable early detection and evaluate treatment options.

- Cardiovascular

- Respiratory

- Diabetic

- Others

By End-user

- Healthcare companies: Healthcare companies use digital biomarkers for drug development and in the development of novel treatments. In clinical trials, they are increasingly used as endpoints for neurological and psychiatric diseases. Digital biomarkers help medical personnel to understand the efficacy of interventions on patients. Technology companies are increasingly conducting clinical validation of digital biomarkers in collaboration with research institutions.

- Healthcare providers

- Others

By Region

- North America: The region will emerge as the highest revenue-generating segment of the digital biomarkers market during the projected period. The increasing use of wearables and mobile apps for activity and disease monitoring, and expanding applications in therapeutic areas, are driving the market’s growth in these regions.

- Europe

- Asia-Pacific

- RoW

Request for Sample Report for segment-wise insights and regional opportunities

Digital Biomarkers Market Vendor Landscape

The digital biomarkers market has witnessed several partnering with to enhance the adoption of this technology. This is expected to intensify the competition among existing players and upcoming startups. With the huge burden caused by the COVID-19 pandemic, government bodies have also shown interest in the development of digital biomarker-based therapeutic solutions. For instance, In April 2022, Labcorp and Medidata collaborated to co-develop digital biomarkers and expand decentralized clinical trials. In September 2022, Sonde Health signed an agreement with Koye Pharmaceutical, to develop a new vocal biomarker detection and monitoring capability for chronic obstructive pulmonary disease in India.

Furthermore, the adoption of digital biomarkers has led to an increase in investments and funding activities to accelerate research on digital biomarkers. In October 2022, General Prognostics, a digital biomarker firm raised $3.25 million for its API for blood to digitize critical blood biomarkers and improve clinical prediction.

Top Digital Biomarkers Market Players

- ActiGraph, LLC: The company’s wearable sensors and software tools accelerate the clinical trial processes and have been deployed in more than 100 pharmaceutical drug trials. Key products include Centrepoint Insight Watch, ActiGraph GT9X Link, and ActiGraph wGT3X-BT. In January 2021 the company partnered with VeraSci to incorporate ActiGraph’s CentrePoint Insight Watch into VeraSci’s Innovation Lab for an NIH-funded study evaluating the relationship between real-time measurements of gait and actigraphy.

- AliveCor, Inc: The company’s personal ECG devices can various cardiac irregularities such as atrial fibrillation, tachycardia, or bradycardia within 30 seconds so that patients can manage their heart health. Key product offerings include KardiaMobile. In July 2021, AliveCor partnered with Acutus to explore remote monitoring for the management and treatment of cardiac arrhythmias.

- BIOGEN INC.: Biogen, as a pioneer in neuroscience, discovers, develops and delivers new medicines for patients living with severe neurological illnesses and related therapeutic adjacencies across the world. Biogen collaborated with Apple to conduct a study using Apple Watch and iPhone to develop digital biomarkers for cognitive health.

Grab your Sample Report Copy for More Players and Vendor-specific Product Offerings

Related Reports:

Digital Biomarkers – Thematic Research

Digital Health in Neurology – Thematic Research

Digital Health in Immunology – Thematic Research

Virtual Care – Thematic Research

About GlobalData

GlobalData is a leading data, analytics, and insights provider in the world’s largest industries. As a leading information services company, thousands of clients rely on GlobalData for trusted, timely, and actionable intelligence. Our mission is to help our clientele ranging from professionals within corporations, financial institutions, professional services, and government agencies to decode the future and profit from faster, more informed decisions. Continuously enriching 50+ terabytes of unique data and leveraging the collective expertise of over 2,000 in-house industry analysts, data scientists, and journalists, as well as a global community of industry professionals, we aim to provide decision-makers with timely, actionable insights.

Media Contacts

Mark Jephcott

Head of PR EMEA

[email protected]

cc: [email protected]

+44 (0)207 936 6400