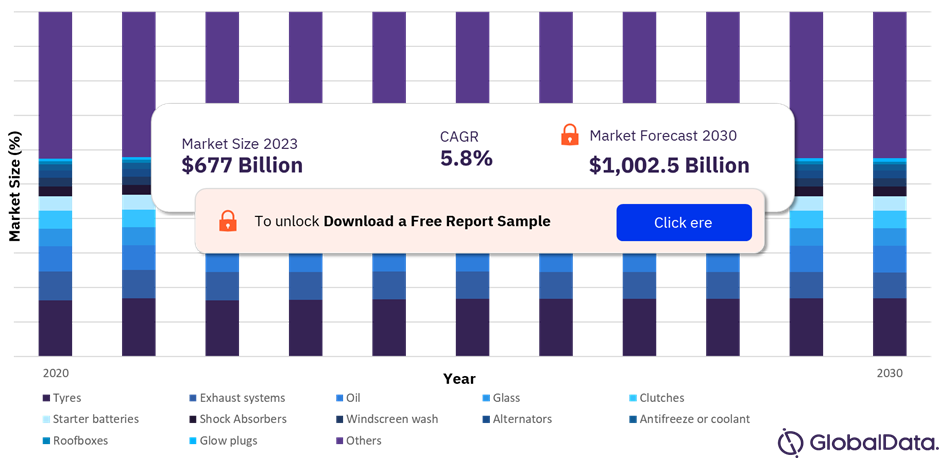

The automotive aftermarket industry size is expected to reach $1,002.5 billion by 2030, according to a new report by GlobalData Plc. Factors such as the changing consumer preferences and behavior, digital transformation, and e-commerce, rise in shared mobility, and substantial effects of technical advancements will drive the market for automotive aftermarkets.

The rise of internet marketplace has provided a platform for aftermarket businesses to engage with a bigger client base. The promotion and sale of aftermarket goods are facilitated by websites that connect merchants and consumers, such as Amazon, eBay, and specialized vehicle markets. As online marketplaces provide a convenient one-stop shopping experience, consumers can explore a wide range of products, compare prices, read reviews, and simply make purchases.

Global Automotive Aftermarket Industry Share, by Component, 2020 – 2030 (%)

Automotive aftermarket outlook report is available with GlobalData Now! Read a FREE sample.

Automotive Aftermarket FAQs

- What is the global automotive aftermarket size in 2023?

The automotive aftermarket size globally is estimated to be valued at $677 billion in 2023.

- What is the automotive aftermarket growth rate?

The global automotive aftermarket is expected to grow at a CAGR of 5.8% over the forecast period (2023-2030).

- What are the key automotive aftermarket market drivers?

The changing consumer preferences and behavior, digital transformation and e-commerce, rise in shared mobility, and substantial effects of technical advancements are the factors contributing to the market growth.

- What are the key automotive aftermarket segments?

Component Segments: Tyres, Exhaust systems, Oil, Glass, Clutches, Starter batteries, Shock Absorbers, Windscreen wash, Alternators, Antifreeze or coolant, Roofboxes, Glow plugs, Others

Product Family Segments: Wear & Tear, Services, Tyres, Mechanical, Crash Repair, Accessories, Consumables

Channel Segments: Vehicle Manufacturer Networks, Garages, Autocenters, Online Sales, Parts Accessories, Tyre Specialists, Fast Fits, Hypermarkets, Crash Repair Centres/Bodyshops, Petrol Stations, Others

- Which are the leading automotive aftermarket companies globally?

The leading automotive aftermarket companies are AGC Inc, Aisin Corp, Benteler International AG, BorgWarner Inc, Bridgestone Corp, Michelin, Contemporary Amperex Technology Ltd, Corning Inc, Denso Corp, Forvia SE, Niterra Co Ltd, Shell plc, and Valeo SA.

Got more queries? Have all your questions answered by enquiring before buying!

Automotive Aftermarket Dynamics

Consumers today have a strong desire to personalize and identify their vehicles. As a result of this tendency, the demand for aftermarket accessories such as specialized wheels, performance enhancements, interior renovations, audio systems, and aesthetic modifications has skyrocketed. Aftermarket businesses respond to these preferences by providing clients with a choice of methods to personalize their vehicles to suit their specific hobbies and tastes.

Many performance-oriented drivers and automobile enthusiasts want to improve the performance of their vehicles.

Engine modifications, exhaust systems, suspension tweaks, and braking components are just a few of the performance enhancements available from aftermarket companies. Customers can improve the performance, handling, and overall driving experience of their automobiles by using aftermarket equipment. Customers routinely seek aftermarket goods to enhance the appearance of their vehicles. Examples are lighting upgrades, window tinting, window body kits, paint jobs, and other aesthetically pleasant alterations. The desire for a unique and aesthetically beautiful vehicle drives the need for aftermarket components that alter a car’s look.

Learn about the automotive aftermarket industry dynamics by viewing report sample right here!

Automotive Aftermarket Report Highlights

- The global automotive aftermarket industry is projected to witness a CAGR of 5.8% from 2023 to 2030, reaching a value of $1,002.5 billion by 2030. Changing consumer preferences and behavior, digital transformation, and e-commerce is anticipated to drive market growth in the future.

- The tyres segment accounted for the highest market share in 2022 and is expected to retain its dominance in the future. The growth in vehicle miles traveled over the years has had a favorable impact on the demand for aftermarket tyres.

- The glow plugs are projected to exhibit the fastest growth over the forecast period. The glow plug market is expanding due to increased demand for commercial vehicles and increased vehicle manufacturing internationally. However, the rise in demand for electric vehicles is impeding industry growth.

- The Asia Pacific is expected to exhibit the fastest growth between 2023-2030. The Asia Pacific automotive aftermarket is anticipated to generate significant income due to the high demand for automotive parts and accessories for maintenance and repair. Additionally, as the use of e-commerce increases, many makers of parts and components are making investments in online marketplaces.

- Key companies in the automotive aftermarket industry analyzed as part of this report are AGC Inc, Aisin Corp, Benteler International AG, BorgWarner Inc, Bridgestone Corp, Michelin, Contemporary Amperex Technology Ltd, Corning Inc, Denso Corp, Forvia SE, Niterra Co Ltd, Shell plc, Valeo SA.

Unlock additional market dynamics impacting the automotive aftermarket industry growth by requesting a sample PDF.

Automotive Aftermarket Industry Scope

GlobalData Plc has segmented the Automotive Aftermarket Industry report by component, product family, channel, and region:

Global Automotive Aftermarket By Component Outlook (Value and Volume, 2020-2030)

- Alternators

- Antifreeze or coolant

- Clutches

- Exhaust systems

- Glass

- Glow plugs

- Oil

- Roof boxes

- Shock Absorbers

- Starter batteries

- Tyres

- Windscreen wash

- Others

Global Automotive Aftermarket By Product Family Outlook (Value, 2020-2030)

- Accessories

- Consumables

- Crash Repair

- Mechanical

- Services

- Tyres

- Wear & Tear

Global Automotive Aftermarket By Channel Outlook (Value, 2020-2030)

- Autocenters

- Crash Repair Centers/Body shops

- Fast Fits

- Garages

- Hypermarkets

- Online Sales

- Parts Accessories

- Petrol Stations

- Tyre Specialists

- Vehicle Manufacturer Networks

- Others

Global Automotive Aftermarket Regional Outlook (Volume and Value, 2022-2030)

- North America

-

- US

- Canada

- Mexico

- Europe

-

- UK

- Germany

- France

- Netherlands

- Italy

- Spain

- Rest of Europe

- Asia Pacific

-

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia Pacific

- Central & South America

-

- Brazil

- Argentina

- Rest of Central & South America

- Middle East & Africa

-

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Want to know more segment-specific insights, download a free sample report.

Related Reports

About us

GlobalData is a leading provider of data, analytics, and insights on the world’s largest industries. In an increasingly fast-moving, complex, and uncertain world, it has never been harder for organizations and decision-makers to predict and navigate the future. GlobalData’s mission is to help our clients to decode the future and profit from faster, more informed decisions. As a leading information services company, thousands of clients rely on us for trusted, timely, and actionable intelligence. Our solutions are designed to provide a daily edge to professionals within corporations, financial institutions, professional services, and government agencies.

Contact Information:

GlobalData Mark Jephcott Head of PR EMEA [email protected] cc: [email protected] +44 (0)207 936 6400

Tags:

Reportedtimes, Extended Distribution, iCN Internal Distribution, Research Newswire, English